Tamarindo Market Analysis

Meet Tamarindo…

Imagine a place where the phrase “Pura Vida”—or “pure life”—isn’t just a slogan, but the very rhythm of the community. That’s Tamarindo. This vibrant coastal town, situated on the northern Pacific coast in the Guanacaste province, has undergone a remarkable transformation over the last few decades, evolving from a quaint artisanal fishing village into a highly developed hub for tourism and international living.

Tamarindo Market Analysis - Matt's Real Estate Investor's Presentation

Today, it’s a bustling town with a diverse array of amenities, including a wide variety of restaurants, shops, and professional services.3 Its appeal is undeniable, drawing people from around the globe who are seeking a change in lifestyle or a new place to retire.4 The significant presence of foreign residents, particularly from North America and Europe, has even earned the town the affectionate nickname “Tamagringo”.5 This mix of global cultures and a laid-back local atmosphere is a powerful driver behind the sustained demand for real estate.

The report provides a data-driven look beyond the picturesque sunsets and world-class surfing.6 It’s designed to give a strategic overview for a real estate investor by analyzing the core demographics, market trends, and rental performance data that define this unique investment landscape.

Table of Contents

Introduction: The Pura Vida Investment

Tamarindo, a dynamic coastal town on Costa Rica’s northern Pacific coast, presents a compelling case for real estate investors. It has evolved from a quiet fishing village into a highly developed tourist hub, drawing a significant international demographic.1 The market is not just about transactions; it’s an investment in the “Pura Vida” lifestyle, a way of life centered on relaxation, community, and appreciating the moment.5 This deep-rooted appeal provides a layer of resilience, as many buyers are motivated by lifestyle changes or retirement plans rather than purely speculative gains.6

This comprehensive analysis aims to provide a data-driven overview for investors, covering demographics, market trends, rental performance, legal frameworks, and infrastructure development. The objective is to highlight both the immense potential and the key risks, enabling a strategic investment approach that navigates the nuances of this unique market.

I. Demographics and Socio-Economic Drivers

While official census data provides a baseline, it does not fully capture the economic engine of Tamarindo.7 The 2022 census cites a population of 7,132, a modest increase from 6,375 in 2011, reflecting an annual growth rate of just over 1%.7 However, the town’s true vitality is found in its large and dynamic “functional” population, including a substantial expat and tourist community.3 Nicknamed “Tamagringo,” the area is known for its high concentration of foreign residents and visitors, particularly from North America and Europe.3

The expat community is largely composed of “location-independent” professionals and digital nomads who have moved to the area to pursue a better quality of life.8 This influx of foreign capital and a high-spending demographic directly influences the real estate market.3 A national-level statistic reveals that tourism accounts for 10% of Costa Rica’s GDP, and Tamarindo’s popularity is confirmed by data showing that 22% of all foreign tourists visited the town in 2016.3 This makes the local economy “solely based on tourism,” tying the real estate market’s health to international travel patterns and the economic stability of key source countries like the United States and Canada.6

Several residency options exist for those looking to relocate, each with its own financial requirements. The “Pensionado” visa is for retirees with a monthly income of at least $1,000, while the “Rentista” visa requires a $2,500 monthly income for two years.5

The “Inversionista” visa, a popular choice for real estate investors, is available for those who invest a minimum of $150,000.5 Additionally, the “Digital Nomad Visa” caters to remote workers with a minimum monthly income of $3,000.5 This variety of options underscores the government’s efforts to attract foreign investment and talent.2

Table 1: Tamarindo Population & Demographics

II. Tamrindo Real Estate Market: Trends and Investment Opportunities

The Tamarindo real estate market is currently experiencing a period of adjustment, creating a potential opening for investors. Since early 2024, there has been a “notable decline in property sales” driven by rising mortgage rates and home prices in North America, highlighting the market’s direct link to its primary buyer base.6 This slowdown has led to an increase in available inventory, a level not seen since 2019-2020, granting active buyers “more negotiation power” and encouraging sellers to compromise on price and closing costs.6 While some sources cite average property appreciation rates of 5-8% over the past decade, the current market dynamic necessitates a more strategic, less speculative approach.16

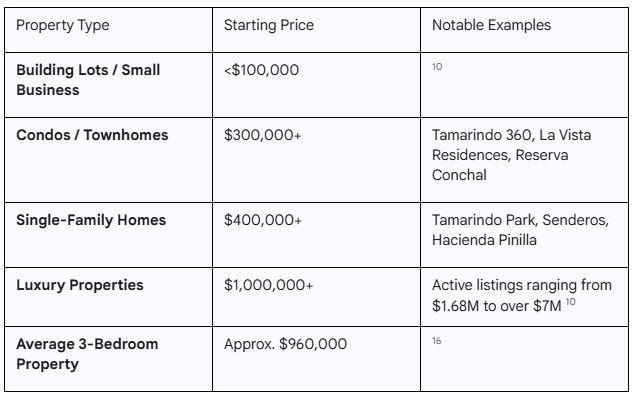

Tamarindo’s property landscape is diverse, offering options for various investment tiers. Building or small business lots start at under $100,000.10 Condos and townhomes have a starting price of around $300,000, while single-family homes and villas begin at $400,000.10 The luxury segment is robust and growing, with premier properties starting at $1 million and reaching up to $9.7 million.10 The average cost for a three-bedroom property is approximately $960,000, reflecting the high demand and the presence of high-end developments.16

A key trend in the market is the rise of master-planned and gated communities such as Tamarindo Park, Senderos, and Hacienda Pinilla.10

These developments are highly attractive to investors due to their turnkey nature, extensive amenities, and focus on sustainability.12 They offer a curated lifestyle with features like beach clubs, fitness centers, and high-end security, mitigating the risks associated with public infrastructure.12 This focus on eco-friendly design aligns with Costa Rica’s national reputation for environmental stewardship, attracting a new generation of environmentally conscious buyers.15

Table 2: Real Estate Market Pricing by Property Type

III. Investment Performance: Rental Yields and Occupancy

The short-term rental market is the cornerstone of a Tamarindo real estate investment. While some sources report average rental yields from 5-8% per calendar month and occupancy rates of around 50% year-round, a more nuanced analysis of the market reveals a vast performance gap between property tiers.27 This is a critical distinction for an investor; success is not about entering the market, but about positioning a property for top-tier performance.17

Data from top-performing properties (the top 10%) shows a significantly higher return on investment than the market average.17 While the typical property achieves an occupancy rate of about 45%, best-in-class properties can reach over 82% occupancy.18 This translates directly to revenue. The median annual income for an Airbnb listing is around $52,605, but a top-tier property can generate more than $14,017 per month, equating to over $168,000 annually.17 The average daily rate (ADR) also shows a similar disparity, with typical properties commanding about $215 per night, while the top 10% can charge over $864.17 This highlights the importance of professional management, premium amenities, and strategic marketing to maximize returns.17

The rental market is also highly seasonal, with a defined peak season from January to March, a shoulder season, and a low season from August to October.17 During the peak season, average monthly revenues can reach $8,176, with occupancy rates around 59.4% and ADRs of $444.17

In the low season, these metrics drop to an average monthly revenue of $3,722 and an occupancy rate of 35.8%.17 The market caters to both couples and larger groups, with a high concentration of one- and two-bedroom properties, but also a significant supply of properties with three or more bedrooms.17 A notable 40.9% of listings have a minimum stay of 30 or more nights, indicating a strong and growing market for extended stays and digital nomads.17

Table 3: Short-Term Rental Performance Metrics

IV. Legal and Fiscal Frameworks for Foreign Investors

Costa Rica’s legal system provides robust protections for foreign real estate ownership. Foreigners have the same rights as citizens to own land, a right guaranteed by the Costa Rican constitution. A key detail to be aware of is the Maritime Zone Law, which restricts outright ownership in the first 200 meters of the coastline. Within this zone, property is held under a concession and foreign ownership is limited to a 49% stake in these rights. Properties outside this zone can be owned with a “fee simple” title, similar to those in the U.S. or Canada.

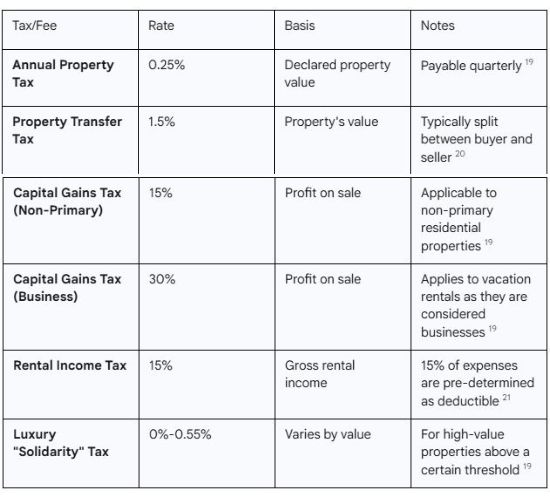

The tax framework for real estate investors is complex and requires professional guidance. While some outdated information may suggest there is no capital gains tax, this is no longer accurate . The current law, in effect since 2019, distinguishes between a primary residence and an investment property. A non-primary residential property is subject to a 15% capital gains tax upon sale. However, a vacation rental is classified as a business asset, and its sale is subject to a 30% capital gains tax. This is a critical point that can significantly impact financial returns. A notable exception is for properties purchased before July 1, 2019, which may be eligible for a one-time flat tax rate of 2.25% of the sales price, a detail that could be a valuable asset in an investment.

Other taxes include a low annual property tax of 0.25% of the property’s registered value and a progressive “solidarity tax” on luxury properties, which can range up to 0.55%.

Rental income itself is taxed at a 15% rate, with a pre-determined 15% of expenses being deductible . It is highly recommended that investors work with a local legal and tax professional to navigate these laws and ensure compliance.

Table 4: Summary of Key Taxes and Fees